vermont sales tax exemptions

Step 4 Include the name and address of the seller. This page discusses various sales tax exemptions in Vermont.

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

In that case include the buyers Vermont Sales Use Tax.

. How to use sales tax exemption certificates in Vermont. Local jurisdictions can impose additional sales taxes of 1. In Vermont certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Tax rates can vary based on the location of your business and the location of your customer plus the levels of sales tax that apply in those specific locations. The state of Vermont levies a 6 state sales tax on the retail sale lease or rental of most goods and some services. To learn more see a full list of taxable and tax-exempt items in Vermont.

Since sales tax rates may change we advise you to check out the Vermont Department of Taxes Tax Rate page which has the current rate and links to lookup specific municipal rates. Use tax is also collected on the consumption use or storage of goods in Vermont. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Geoffrey Pizzutillo Vermont Growers Association We are glad that the Senate put back the tax exemptions. An example of an item that is exempt from. In many states but not all states the purchase of goods and services by state or local governments or by nonprofits are exempt from sales tax.

Business and Corporate Exemption Sales and Use Tax. To claim a tax exemption for the transfer from an individual or business to a business controlled by the transferor. Contact us to schedule your custom sales tax training at a date and time.

The Basics of Sales Tax Exemptions. 970131 and 54. 974113 with the exception of soft drinks.

Ad New State Sales Tax Registration. There were sales tax exemptions that we fought for which is really the purpose of the agricultural designation said Executive Director Geoffrey Pizzutillo of the Vermont Growers Association. Sales Tax Exemptions in Vermont.

Sales Tax Exempt Exemption information registration support. There are additional levels of sales tax at local jurisdictions too. The Vermont Department of Taxes has updated its fact sheet on the taxability of agricultural machinery equipment and supplies.

Medical Equipment Supplies Exempt Supplies Taxable Food Food Products and Beverages Exempt Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. 53 rows Exemption extends to sales tax levied on purchases of restaurant meals. Vermont has 19 special sales tax jurisdictions.

The state of Vermont levies a 6 state sales tax on the retail sale lease or rental of most goods and some services. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. Present sales use tax exemption form for exemption from state hotel tax.

Vermont first adopted a general state sales tax in 1969 and since that time the rate has risen to 6. Soft drinks are subject to Vermont tax under 32 VSA. Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7.

Vermonts Sales Tax Home Page Vermonts Sales Tax Statutes Vermonts Sales Tax Regulations Identify the purpose use and location of manufacturing purchases which is an important internal control to ensure the proper administration of the sales tax operations. South Dakota SD No reciprocity with State of Vermont per 1-800-TAX-9188. 2022 Vermont Sales Tax Changes Over the past year there have been one local sales tax rate changes in Vermont.

Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0156 for a total of 6156 when combined with the state sales tax. This page describes the taxability of services in Vermont including janitorial services and transportation services.

Our website at wwwtaxvermontgov or can be obtained directly from the Vermont Department of Taxes PO Box 547 Montpelier VT 05601-0547. Purchasers are advised that the exemption allowed by Vermont is a use-based. Currently combined sales tax rates in Vermont range from 6 to 7 depending.

South Carolina SC x No Exemption based on the status of the purchaser. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. You can lookup Vermont city and county sales tax rates here.

Vermont has a destination-based sales tax system so you have to pay. S-3pdf 8943 KB File Format. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 1.

Vermont Sales Tax Exemption Certificate for MANUFACTURING PUBLISHING RESEARCH DEVELOPMENT or PACKAGING 32 VSA. Pre-manufacturing and post-manufacturing do not qualify. Wednesday March 16 2022 - 1200.

To learn more see a full list of taxable and tax-exempt items in Vermont. 974114 15 16 24. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

10 rows Vermont Sales Tax Exemption Certificate for Agricultural Fertilizers Pesticides Machinery. The maximum local tax rate allowed by Vermont law is 1. Vermonts state-wide sales tax rate is 6 at the time of this articles writing with local option taxes potentially adding on to that.

Limited items are exempt from sales tax. To apply for tax exemption when the vehicle being registered is equipped with altered controls or a mechanical lifting device. Step 5 Describe the merchandise being resold.

In its most basic form a sales tax exemption certificate alleviates a company from collecting and remitting sales tax on certain products and services. The range of total sales tax rates within the state of Vermont is between 6 and 7. Step 6 Check the box with the reason for claiming an exemption.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. Tax Exemption - Disabled Person. Most businesses reselling the merchandise being purchased will check the first box For resalewholesale.

While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. It is designed to help businesses determine the agricultural machinery and equipment that qualifies for an exemption from Vermont sales and use tax.

The state-wide sales tax in Vermont is 6.

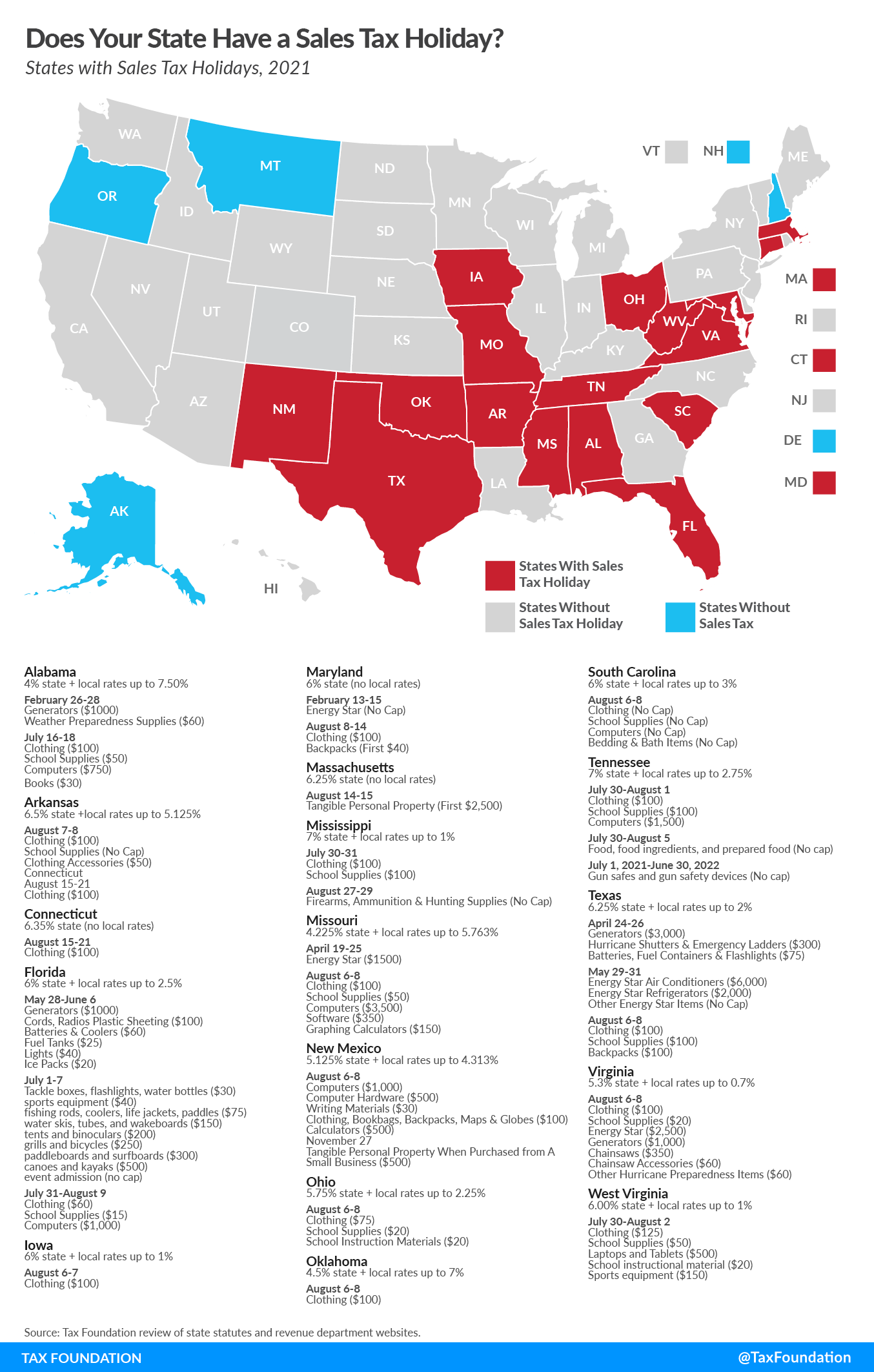

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Sales Tax Rates And Exemptions For Agricultural Manufacturing And Download Scientific Diagram

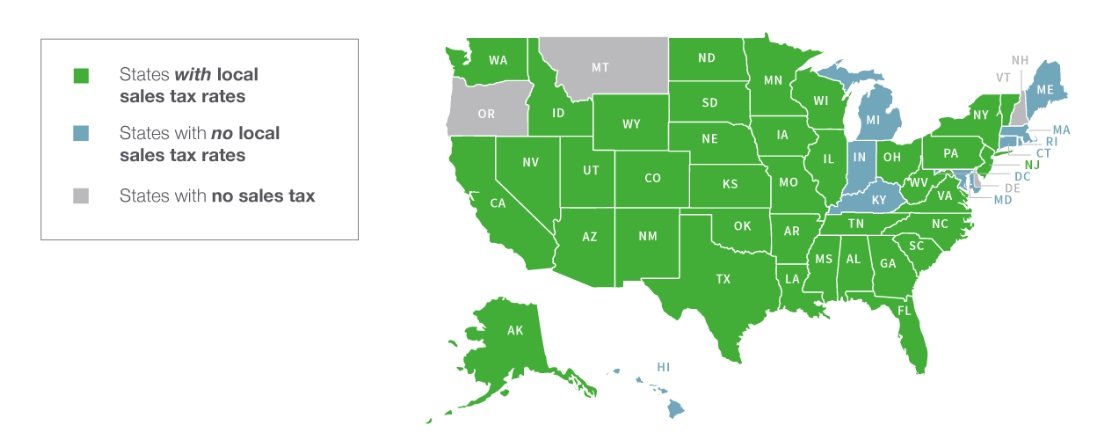

Sales Tax By State Is Saas Taxable Taxjar

States Without Sales Tax Article

State By State Guide To Taxes On Retirees Retirement Tax States

Sales Tax Collection Requirements For Us Sellers And 7 Steps To Ensuring Compliance

Sales Tax Exemption Consumer Healthcare Products Association

States With Highest And Lowest Sales Tax Rates

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Push Is On To Expand Vt Sales Tax To Services Ethan Allen Institute

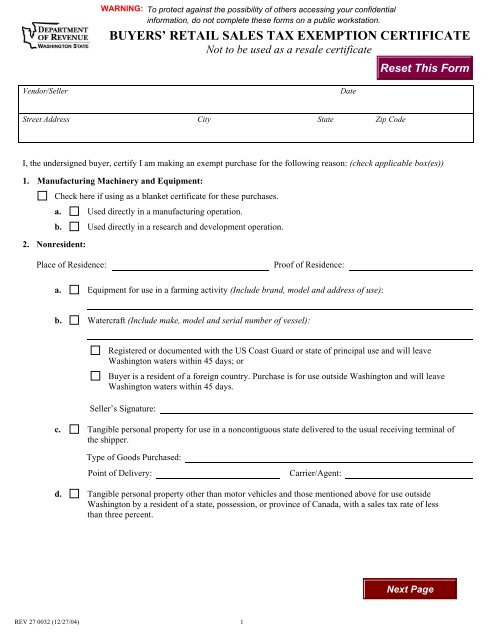

Buyers Retail Sales Tax Exemption Certificate

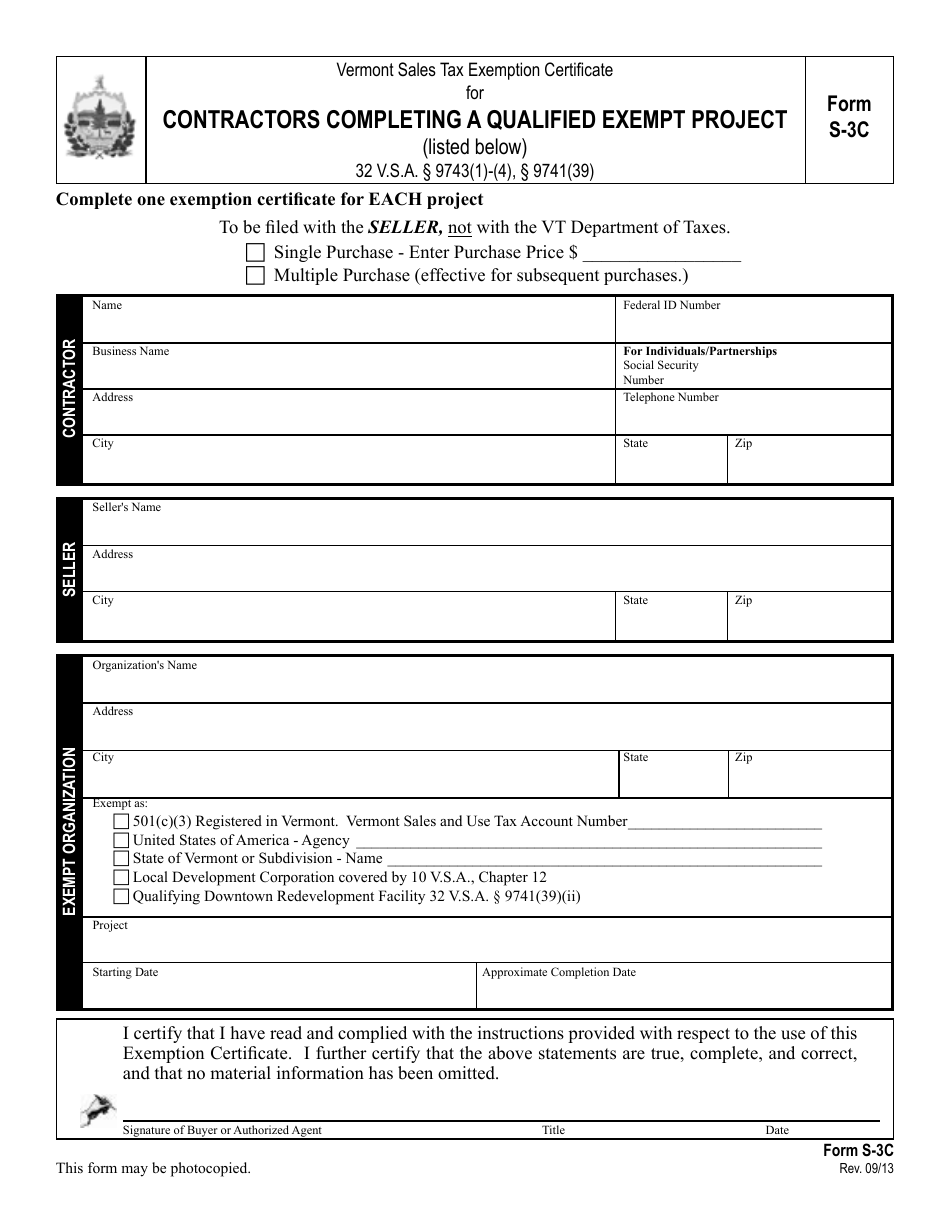

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Printable Vermont Sales Tax Exemption Certificates

Sales Tax Exemptions Finance And Treasury

Setting Up Sales Tax In Quickbooks Online

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)